Interactive Brokers is a famend and trusted broker providing easy access to world markets. With their “White Branding,” they provide a white label program for brokers to create personalized trading platforms. With these, brokers are able to launch a custom-made foreign foreign money trading platform with the perception of singularity from their model, but built on a confirmed technical platform. The equilibrium between novelty and safety makes white label forex app improvement cost-effective for increasing businesses. Today’s fast-changing area of finance and electronic buying and selling drives programmers and builders to ideas that create a complete new way to make money and enhance the wealth of private traders and institutional traders.

White-label answer providers offer excellent authorized and regulatory help, so you meet trade requirements. This consists of assistance with obtaining needed licenses and adhering to local regulations. These applications are ideal if you want to enter the foreign exchange market quickly and save on growth prices.

Finances Administration Tips

With greater than 80 Foreign Exchange currencies obtainable, the provider provides MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, B2Trader, and other buying and selling platforms. Your white label solutions supplier has all of those instruments and sources able to go, and inside a brief area of time, you can leverage all their present relationships, so you probably can concentrate on building your shopper base. With an FX brokerage platform designed for efficiency, you gain entry to a collection of payment providers, a strong back office, and the ability to scale rapidly. Whether Or Not you’re an IB able to transition right into a full brokerage or a longtime agency in search of a turnkey white label answer, this guide will stroll you through the important components of choosing the proper supplier. Leverate has positioned itself as a premium white label provider specializing in personalized brokerage solutions.

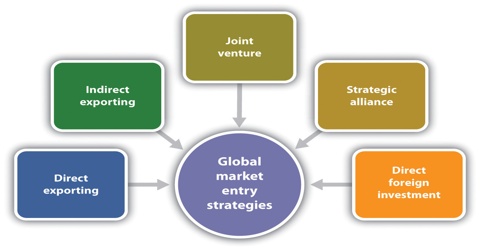

Launching a foreign exchange brokerage in 2025 has reworked from an unique area of business titans and closely capitalized firms into an accessible alternative for visionary entrepreneurs. X Open Hub provides liquidity and expertise solutions for financial establishments, brokerages, and banks. They present deep institutional liquidity on over 5,000 global devices, together with foreign exchange, cryptocurrencies, indices, commodities, shares, and ETFs. By choosing a white-label foreign exchange program, you can focus more in your purchasers and less on the technical challenges of working a foreign exchange brokerage. Traders at present anticipate platforms with options like superior charting, a quantity of order sorts, and threat management instruments.

High 10 Foreign Exchange White Label Options In 2025

Match-Trade differentiates itself with its progressive all-in-one and proprietary Match-Trader platform with built-in Consumer Office, CRM, and liquidity bridge, saving brokers from putting collectively third-party techniques. We help you supply a seamless user expertise with powerful features for accessing multiple markets (including crypto markets). Your brokerage can benefit from Alphapoint’s strong focus on security, together with our advanced encryption and safe protocols to guard your client information and transactions.

Many Foreign Exchange brokers want the necessary software program assets, servers, and protocols to handle the buying and selling platform and its components; subsequently, the connection of such a platform to the company’s infrastructure turns into inconceivable. In this case, you need to all the time check the technical specs of any software or software program.6. Cross-PlatformityToday, there are numerous devices that give entry to buying and selling, be it a pc, tablet, or phone.

- Regardless Of being the industry’s longest-standing platform supplier, MetaQuotes continues to dominate the market with its MetaTrader ecosystem.

- One of the most useful advantages of a white label solution is that the platform may be branded to replicate your brand.

- The relationship between forex trading and white-label options is extra than just beneficial—it’s a blueprint for sustained success.

- Every provider listed includes platforms with customization, superior analytics, integration choices, and rapid deployment.

- Their pricing structure includes tiered options beginning at approximately $5,000 month-to-month with extra liquidity and volume-based considerations.

Become Part Of The Finxsol Group For Normal Fintech Trade Updates

CTrader White Label Forex Program is renowned for its superior trading technology, including algorithmic buying and selling instruments, Degree II pricing, and cloud-based scalability. Their platform supports foreign exchange, equities, and cryptocurrencies, with customizable dashboards for each retail and institutional shoppers. CTrader’s white-label foreign exchange Program is popular among prop trading firms because of its MAM/PAMM account instruments and clear payment buildings.

Model Customization

AlphaPoint excels for brokers seeking to bridge traditional foreign exchange with cryptocurrency offerings. Their expertise supplies seamless integration between asset lessons, permitting you to offer complete buying and selling choices to clients with diverse pursuits. UpTrader provides comprehensive white label solutions with specific energy in rising markets and CIS areas. Their expertise focus emphasizes fast deployment and cost-effective operations. It is seen within the rising variety of regionally targeted brokerages, niche buying and selling White Label Forex Solution platforms, and community-first firms that have emerged globally.

Are you on the lookout for a fast, cost-effective way to launch your personal foreign exchange brokerage with out the hassle of building everything from scratch? The right forex white label solutions provide every thing you need, together with the MT4 and MT5 buying and selling platforms, a bespoke in-house platform (LogixTrader), deep liquidity, and a fully customisable admin portal to handle your… Working your brokerage as a white label Foreign Exchange dealer entails leveraging the technology and infrastructure of an established Forex supplier instead of creating them from scratch your self.